At the time of writing, a new member discount of 10% was available, taking the price nearer to $70, while there's a 30-day risk-free trial you can partake in too. You can manually add transactions as needed, and Quicken allows you to snap a picture of your receipts and save them in the program.įrom a cost point of view, the Premier option is usually $77.99 per year, making it the most expensive of the Quicken range of packages, bar the business package. With the mobile apps, you can view all account balances and transactions, the status of your budgets, and alerts and notifications. Unlike some other desktop programs that require the use of an intermediary program like Dropbox, Quicken Premier directly syncs with its mobile apps without needing any other software.

#Best mac financial software 2017 for android

While Quicken Premier is probably best used on a PC, you can also manage your budget and add or edit transactions when you're away from your desktop using the companion app for Android or iOS phone. With Quicken on the web, you’re able to view balances, budgets, accounts, and transactions, see spending trends by category, payee, and monitor investment performance.

Quicken Premier review: Accessibility and priceįor the first time, Quicken now allows you to manage your money on the web, rather than purely through desktop software. Alternatively, you can specify an amount that you'd like to have saved by the time you retire and see how much you'll need to save each month to reach that goal.

If you enter when you plan to retire and how much you're putting into your IRA into the retirement calculator, you'll get an estimate of the amount you'll have saved by the time you give up work. Similar to setting savings goals, you can define retirement goals for your finances and investments too. You can sync Quicken directly to your brokerage account to transfer balances and trade history, and then use the investment management tools on offer to provide various analytics of your portfolio, such as risk versus return, and compare your portfolio to the market. If you own securities and trade stocks and other investment vehicles, Quicken Premier is the leading finance software around in this respect too. Quicken Premier review: Investment tracking There are tax reports too, and Quicken Premier is the only software in our line-up that allows you to export your data to the best tax software programs. These quick reports can be displayed on your home page, if you so wish, which is customizable, and the data easily exported directly to Excel as well.

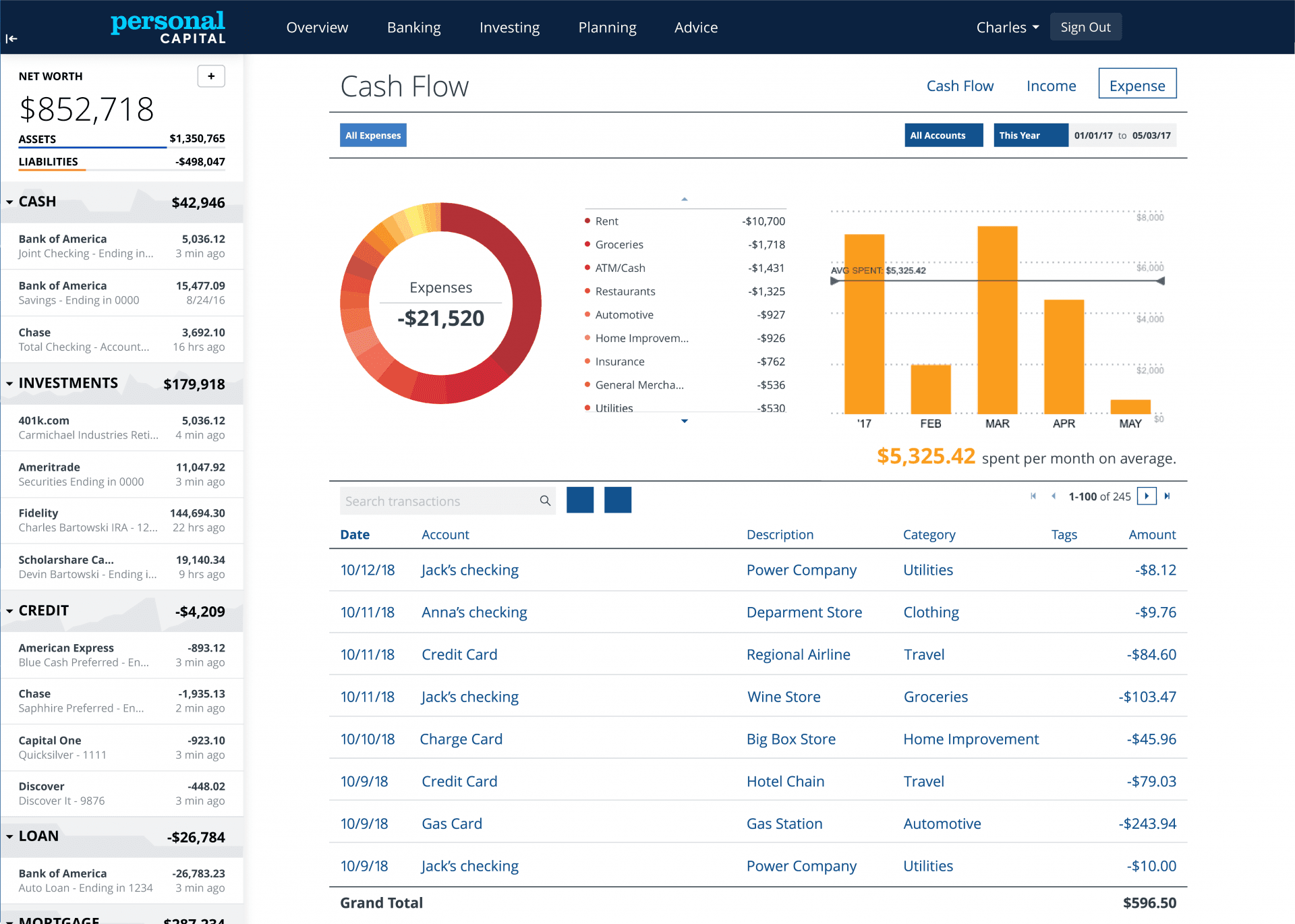

– with the individual transactions listed below. In this instance, the quick report displays a pie chart of expenses based on categories – bills, shopping, entertainment, food, etc. In addition to the traditional reports, you can see quick overview reports of spending and transactions. Many of the reports simply display data and numbers, but there are some that provide visual representations of the data, in the form of a bar or pie chart, as well. There is the option to choose from a predetermined date range, such as month or year-to-date, or to choose custom dates. Report categories include banking, spending, comparison, investing and tax reports, which can usually then be split down into further sub-sections such as cash flow, spending by payee, budget and income versus expense. These can be saved for your own records or use in other programs. Quicken Premier offers several helpful reports that will provide an overview of your spending habits and plot them against your income. If you know your car insurance payment is due in January and June, setting future transactions and reminders using the calendar can help you remember when those payments are approaching. The Quicken Premier software also offers the option to set future charges without them affecting your current budget and balances. You choose the account from which you want funds to be allocated each month.Īs Quicken doesn't control your bank and order a transfer, it simply hides the funds from that account so you can transfer the money to the account manually later if you have an actual savings account set up in your bank. You create the account, set the goal amount and the due date. Quicken Premier has saving goals and planning tools that can help you earmark money for such special purposes. (Image credit: Quicken ) Quicken Premier review: Savings goalsĪnother option on Quicken Premier is to set saving goals, taking that amount you didn't spend and putting it toward a large purchase or vacation.

0 kommentar(er)

0 kommentar(er)